Your trusted partner for Merchant Processing Solutions

We put $$ back in your pocket

Your trusted partner for Merchant Processing Solutions

We put $$ back in your pocket

Business Funding

No hard credit pull

6 Months Bank Statements

$20K - $1Million

in Working Capital Amount

1-3 Days

Funds Received Fast

Merchant PROCESSING Solutions

Unlock the potential of seamless payment processing with PayDriven. As a leading merchant processing business, we empower businesses across industries to optimize their payment solutions and drive growth. With our secure, efficient, and reliable payment processing services, you can streamline transactions, increase customer satisfaction, and boost your bottom line.

Whether your business is online or in person, we want to help you with all your payment needs. Contact us now to learn more and schedule a consultation. Together, let's unlock your business's full potential while putting money back in your pocket.

Payment Terminals for Small Business

POS Systems & Software Integrations

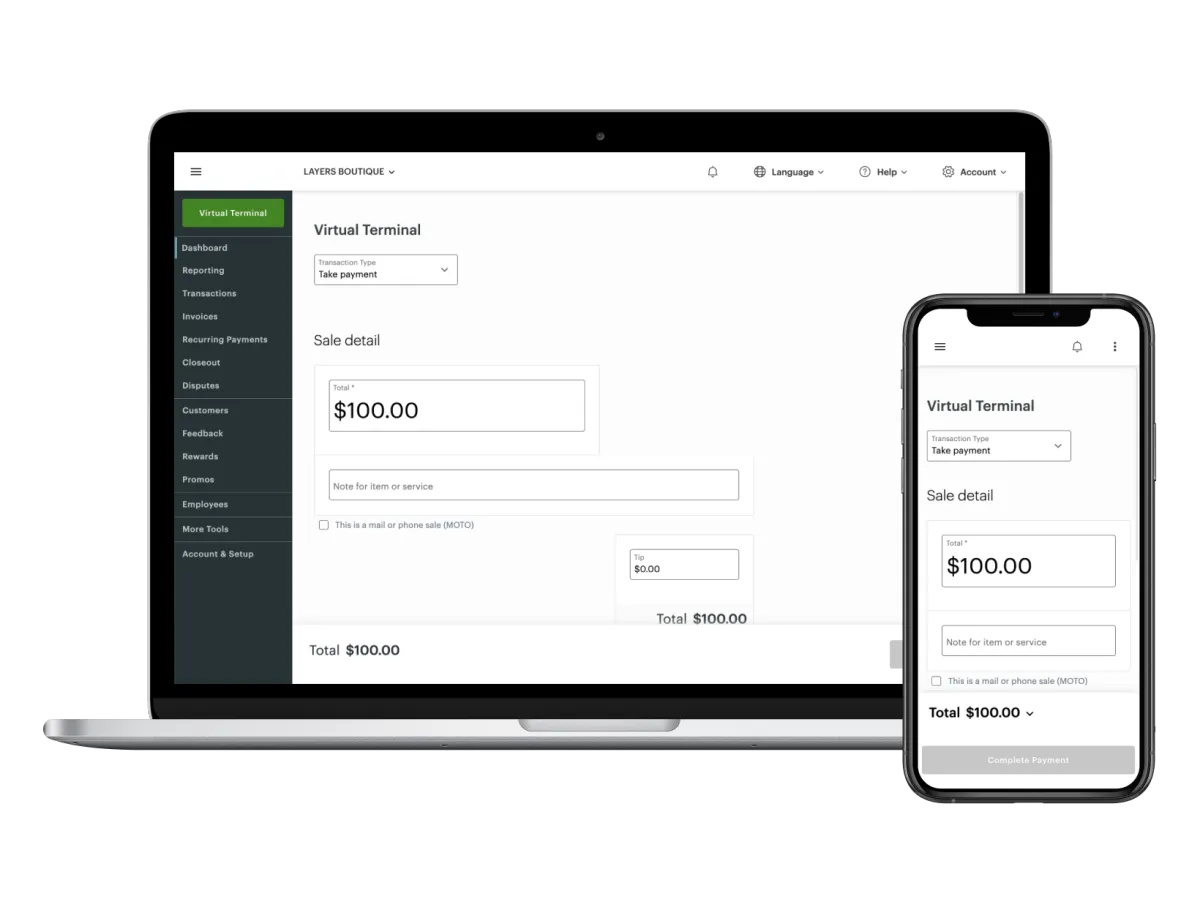

Virtual Terminals & Gateways

Mobile Payments

eCommerce Solutions

Value Added Services

Easily Accept All Major Payment Types

Industries We Serve

Restaurant & Food Business

Retail

Service

Legal

Medical

Ecommerce

High Risk

Our Blog

Business & Payments News

Explained: What is a Merchant Processor and How Can It Benefit Your Business

a merchant processor is like a cool middleman that handles the electronic payment transaction between you and your customers.

If you're a business owner, you probably know that accepting payments is essential to keep the cash flowing. However, you may not know much about the magic behind the scenes of payment processing. Let's take a fun ride and explore what a merchant processor is and how it can benefit your business.

A merchant processor, also known as a payment processor, is an intermediary that handles electronic payment transactions between merchants (businesses) and customers. These transactions include debit card and credit card transactions, as well as other forms of electronic payments such as mobile payments and e-wallets. When a customer makes a payment, the merchant processor verifies it and transfers the funds to the business's account.

In simple terms, a merchant processor is like a cool middleman that handles the electronic payment transaction between you and your customers. They take care of all the technical stuff, like verifying the payment, transferring the funds, and keeping your business safe from fraud. They offer a range of services, including payment processing, fraud detection, payment gateway integration, and settlement to your account.

With that said, here's how having a merchant processor can benefit your business...

Accept Electronic Payments

Payment processing involves receiving and verifying payment information and transmitting it to the issuing bank for approval. Once the payment is approved, the merchant processor transfers the funds to the business's account.

Payment gateway integration allows businesses to accept payments online through a secure portal. Payment gateways are essential for e-commerce businesses and require merchant processors to integrate their services.

Settlement services involve transferring funds from the merchant processor's account to the business's account. Settlements can be done on a daily or weekly basis, depending on the business's preferences.

Security & Protection

Fraud detection is a critical service offered to prevent fraudulent transactions. Merchant processors use sophisticated algorithms to identify and flag suspicious transactions, protecting businesses from fraud. Most also offer advanced fraud detection and prevention tools to protect your business and your customers.

Customer Support

Payment processing issues can arise, and having reliable customer support can make a difference. Ensure the merchant processor offers responsive customer support to address any issues that may arise.

Understanding Fees

Merchant processors charge fees for their services, including transaction fees, monthly fees, and chargeback fees. Ensure you understand the fees and their impact on your business before signing up.

Payment methods: Different customers prefer different payment methods. Ensure the merchant processor supports the payment methods your customers use to avoid turning away potential sales.

The Best Choice for Your Business

By now, you know that a merchant processor is a vital tool for any business that wants to accept electronic payments. In fact, it's the ONLY tool to legitimately accept electronic payments as a business. With payment processing, fraud detection, payment gateway integration, and settlement services, it's a no-brainer!

Choosing the right merchant processor can be a game-changer for your business. It can help you save time, money, and headaches, and provide your customers with the payment options they expect. Ensure you choose the right merchant processor for your business by considering fees, security features, customer support, and payment methods supported. Sign up for a merchant account today and take your payment game to the next level!

At Coast to Coast Payments, we have partnered with the top acquiring banks to provide the best rates, innovating technology and premium customer service. Don't miss out on the benefits of seamless payment processing and fraud protection as well. Join the thousands of businesses that have already made the switch to a merchant processor and take your payment game to the next level.

Sign up for a merchant account today

Sign up today and start accepting payments like a pro!

Los Angeles, CA | New York, NY

(888) 560-7689